How to place an order in EUR on the Primary Market?

Overview

On the primary market, an End User can place orders in Fiat Currency (if the End User pays by credit card with Stripe) or in Cryptocurrency (if the End User pays with his Wallet).

Orders in Fiat Currency can only be made on the primary market, not the secondary market.

In order to compare all orders, we need a same currency for all of them. We chose Fiat Currency (Ex EUR), which means for each Cryptocurrency order, the amount is converted in Fiat Currency with the current conversion rate when the order is placed.

To explain how the order system works, let’s take the following example with a listing (to make it simple, we exclude fees from the example):

Alice places a 1 XTZ order, 1 XTZ = 5 EUR. So Alice orderamount is 5€.

Bob places a 8€ order by credit card, Alice’s order is superseded.

Let’s say now 1 XTZ = 10€. Satoshi places a 1 XTZ order, so Satoshi order amount is 10€ and Bob’s order is superseded.

Let’s say there was no new order until the end of the listing. When the listing ends, Satoshi gets the token from the listing in exchange of the 10€.

As an End User, I can place a new order rfor an existing listing by credit card in EUR, thanks to our third party service Stripe.

When an End User pays with Stripe and wins the auction, the money (in EUR) goes on your Stripe account. You will need to have a Stripe account so the End Users can pay by credit card.

Thanks to our partnership with Stripe, it takes approximately a couple weeks to create a Stripe account (vs. a couple months for solutions that don’t have a partnership with Stripe).

About gas fees, fees and royalties

Gas fees

Gas fees refer to the fees that users pay for the use of a blockchain network to validate a transaction or operation. These fees are crucial for the efficient functioning of the blockchain network and serve as incentives for miners or validators to process transactions quickly and accurately.

On the primary market, gas fees are incurred when

An End User wins the auction and pays in Tezos - gas fees paid by the End User.

A token is minted - gas fees paid by the Issuer Batch Minter wallet.

On the secondary market, gas fees are incurred when:

An End User creates a listing in Tezos - gas fees paid by the End User.

An End User places an auction in Tezos - gas fees paid by the End User.

An End User wins the auction and pays in Tezos - gas fees paid by the End User.

An auction is claimed - gas fees paid by the Issuer Batch Minter wallet.

Fees

What are management fees?

Management fees refer to the fees paid by users to platform owners for the use of their services and are common in both primary and secondary markets.

These fees can be customized based on the plan chosen by the platform owners, and can include a percentage of the transaction as well as charges incurred by third-party service providers. These fees play a crucial role in the functioning of the platform, enabling owners to sustain and improve their services while providing users with reliable and efficient solutions. It is important for users to understand the fee structure of a platform in order to make informed decisions and minimize costs associated with their transactions on the platform.

For instance, let's consider a custom NFT marketplace where a marketplace owner lists an NFT for sale, and the platform charges a 2% fee on the final transaction value. Those 2% of management fees are composed of 1% for Eniblock, 1% for the marketplace owner.

If a user buy the listed NFTS with a price of 10€, the user will paid 10,2€

0.2€ of Management Fees

0.1 € for the marketplace owner

0.1 € for Eniblock

10 € of sales revenue for the marketplace owner and

Similarly, if the user places an auction in XTZ or any other fiat currency.

Royalties

Royalties, in general, refer to a commission paid to the original creator of a literary or artistic work by the person or entity who is utilizing or exploiting that work.

In the context of Web3 Marketplace, NFT royalties refer to the commission or percentage of the sale received by the creator of an NFT each time it is sold on the secondary market. The creator is the natural or legal person who has created an NFT representing an underlying asset they own.

Let's consider a custom NFT marketplace where an End User sells a NFT with of an Artistic Art on the secondary market with 2% Manegement fees (1% for Eniblock, 1% for the owner of marketplace) and 10% royalties for the Author or the art. If an another End User wins a 10€ auction, he will pay 10,2€ + gas fees XTZ:

0.2€ of Management Fees

0.1 € for the marketplace owner

0.1 € for Eniblock

1€ to the royalties beneficiaries, the Author of the art

9€ to the Enduser Seller

The gas fees amount in XTZ , that will be set when the auction ends

Here are the chronological steps when an End User places an order in EUR:

How to let the End User to pay with Stripe?

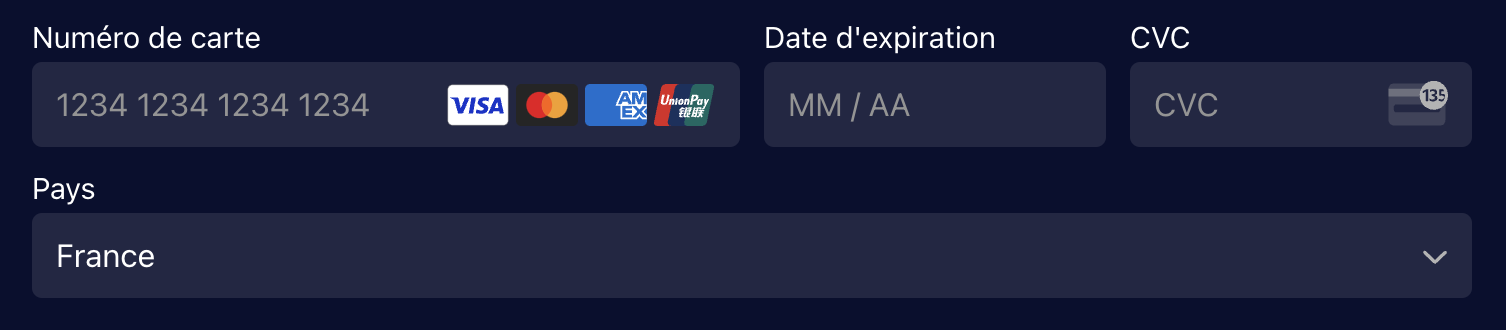

When an End User wants to place an order on the primary market in EUR, first he needs to indicate he wants to pay by credit card.

Here is an example of front-end:

The front-end then has to call an endpoint to get Stripe settings, in order to allow the payment and get 2 parameters in the response: "apiKey" and "connectedAccountId".

Here is the link to the API documentation to get the Stripe information:

https://sandbox.nfts.eniblock.fr/redoc/offering#operation/getStripeConfig

How to place an order

When an End User places an order amount, we highly recommend you in your front-end to:

Check if the order amount matches the requirements about the minimum order price: https://xdevtechnologies.atlassian.net/l/cp/k9nNx9XY

Convert the XTZ amount in EUR: How to convert XTZ amount in EUR and vice versa?

Calculate the fees: [DEVELOPER GUIDES] - How to calculate the fees?

Those 3 steps are highly recommended (to display important information for the End Users) but not mandatory.

Place an order on the primary market

Use case

When the End User validates the amount of the order, it creates an order in the database, which is not active yet. To activate the order, the payment must be done by the End User and then Stripe gets the authorization from the bank.

API

Here is the link to the API documentation to place an order on the primary market as an End User:

https://sandbox.nfts.eniblock.fr/redoc/listings-trades#operation/placeOrderPrimaryMarket

The back-end then sends a clientSecret that would be used by the front-end to perform the Stripe payment.

End User pays with Stripe

Once the End User has placed an order on the primary market, you can redirect him to the front-end component provided by Stripe.

Once the payment is validated by Stripe, the order will be automatically activated.

The End User then receives a confirmation email.

Display the list of all order(s) for this specific End User

Use cases

As an End User, I want to be able to check the list of all my orders(s).

As an End User, I want to be able to check all my current orders and probably sort them by superseded or still winning the auction.

This list is of course not mandatory but highly recommended for a smooth End User experience.

When you display the list of his orders for a specific End User, you have the possibility to make the difference between orders that are currently winning the listing and the others that have been superseded.

API

Here is the link to the API documentation to check the list of all order(s) of a specific user:

https://sandbox.nfts.eniblock.fr/redoc/listings-trades#operation/getOrdersByAccountId

This step is highly recommended (to display important information for the End Users) but not mandatory.